Availability

PLATFORM & TOOLS

CGS International eWealth platform

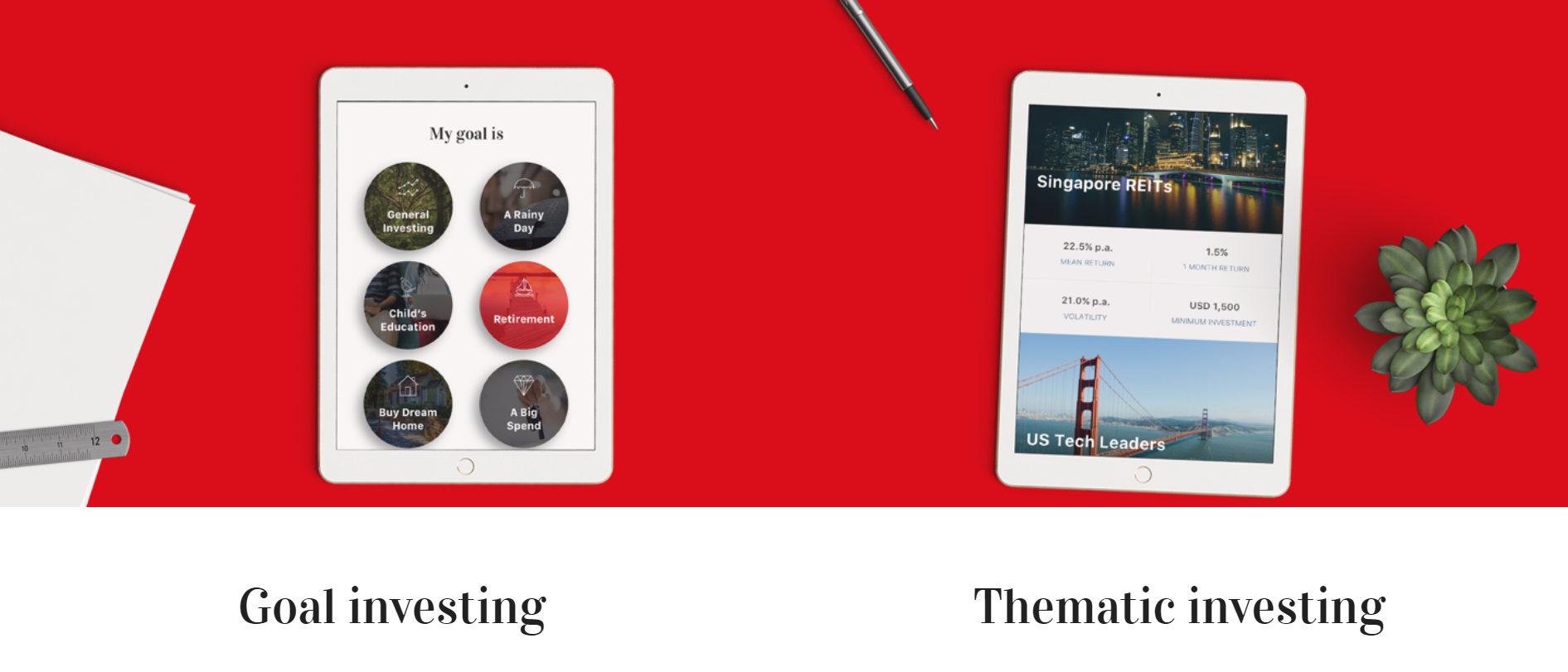

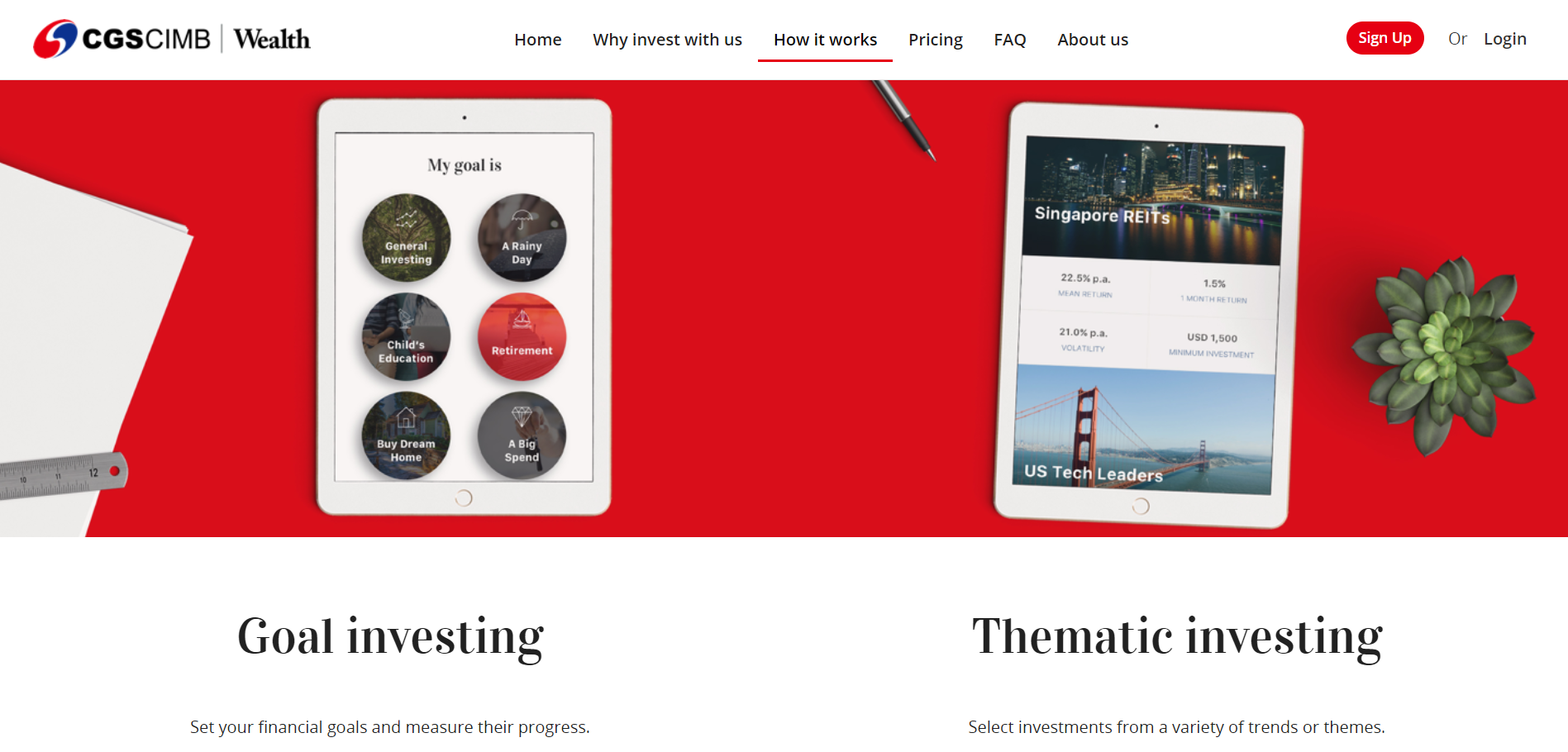

CGS International eWealth platform provides investors with our very own robo-advisor, with the vision of making investment and wealth management simple for retail investors. Powered by fintech, our eWealth platform guides clients in selecting the appropriate portfolio to meet their financial objectives – be it to invest for retirement or funding for a child's education (known as Goal-based investing). The robo-advisor recommends portfolios based on the individual client’s risk appetite. For experienced investors with higher risk tolerance, CGS International eWealth platform offers unique Thematic portfolios that capitalises on cyclical or structural trends or investment themes regionally and globally with the aim of potentially generating superior returns.

Why CGS International eWealth platform?

Key Features

The eWealth platform, powered by fintech, provides intuitive and insightful information for clients to make informed investing decisions. Making investing, truly simple.

-

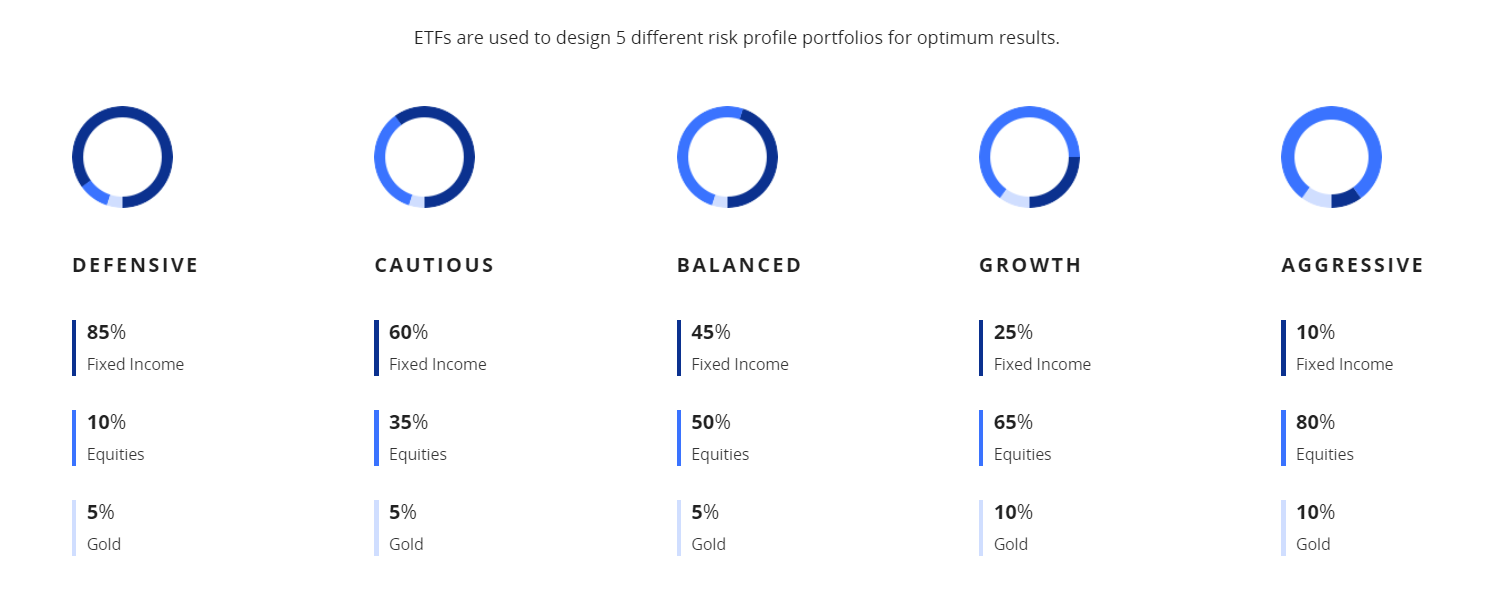

Defensive

-

Cautious

-

Balanced

-

Growth

-

Aggressive

-

S-REITs

-

US ESG

-

US Fed Comes Alive

-

US Gaming

-

US Refinery

-

US Tech Leaders

-

China Internet

-

Hong Kong Consumer

-

Hong Kong Technology

Performance Tracker Our eWealth platform allows clients to check on their portfolio performance, empowering them in tracking their goal progress and making necessary adjustments. |

Customised Portfolios Our eWealth platform has an in-built algorithm that assesses clients' risk profile. Based on what it knows about the client, it recommends an appropriate portfolio to suit the individual's needs. |

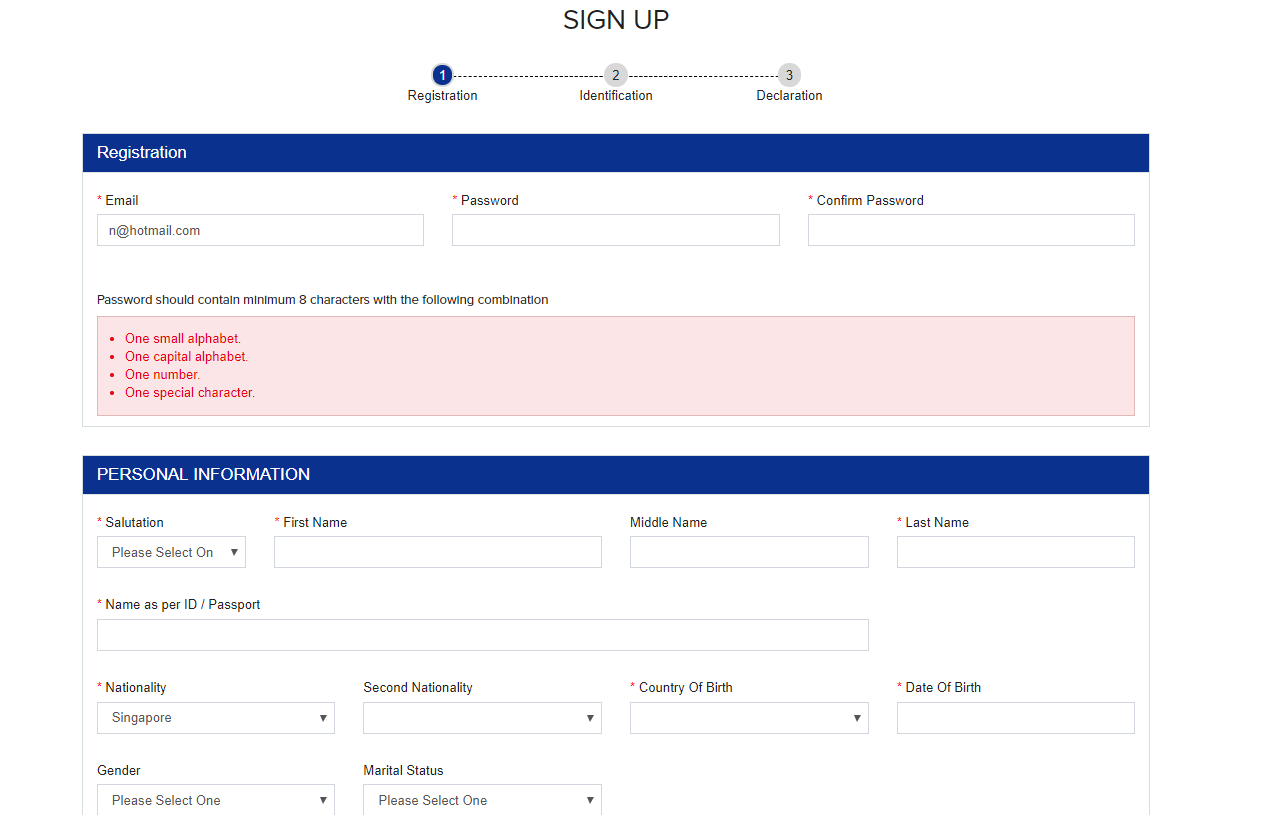

Invest Fast Fast and easy online account opening process for clients to start investing within 1 to 2 days. |

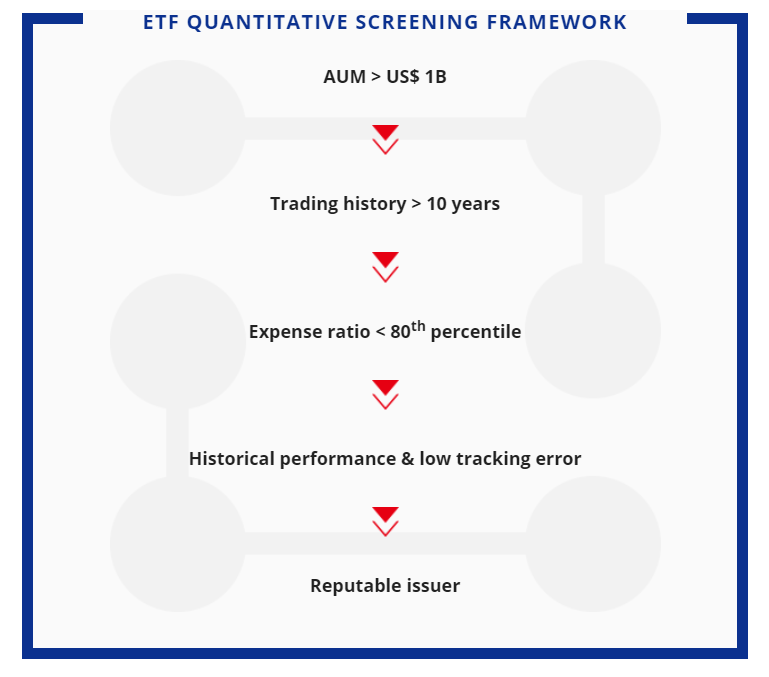

Unbiased Portfolio Construction Our portfolios are constructed and driven by historical data which reduces the risk of biased estimates and forecasts. |

Market Return and Excess Return Portfolios eWealth provides portfolios that seek to deliver either market returns or excess market returns subject to investors' risk appetite, giving choices to investors - from novice to experienced investors. |

More Choices More investment choices will be available on the eWealth platform over time as we seek to make investments simpler and relevant to our clients. |

Risk Profiling The eWealth robo-advisor assesses clients' risk profile through a concise questionnaire. Clients will then be profiled based on their risk tolerance and an appropriate portfolio will be suggested. |

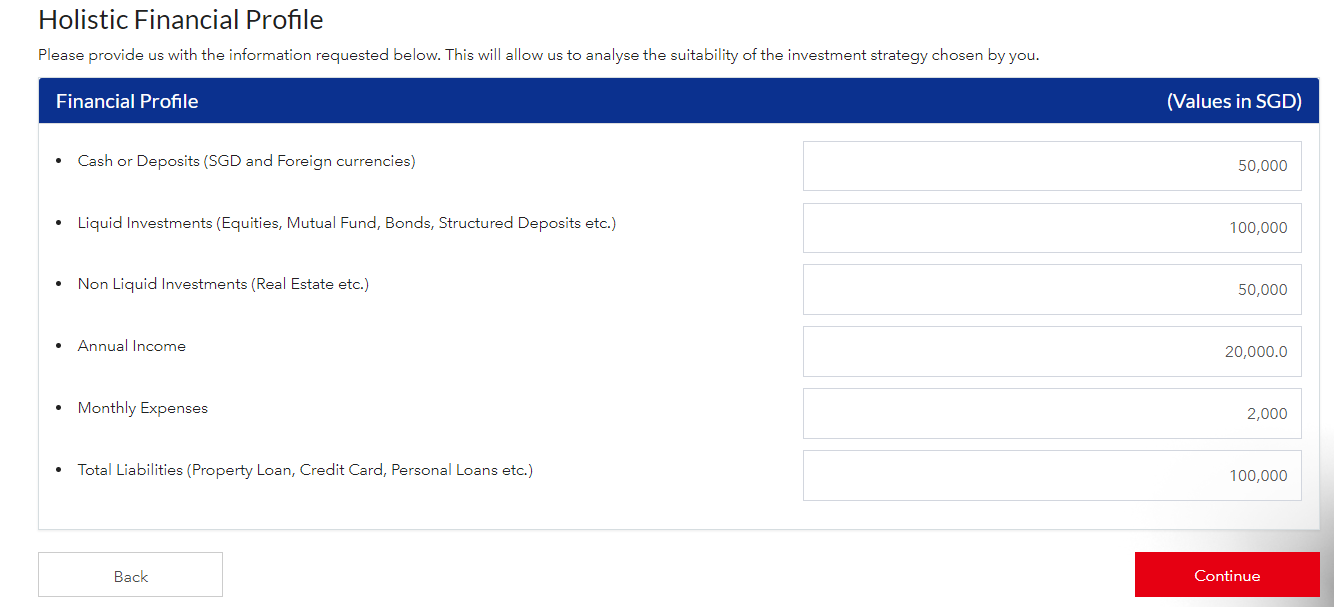

Financial Profiling In addition, the eWealth robo-advisor helps analyse a client's financial resources and assesses his/her suitability in investing in Thematic portfolios. This step provides clients with a more holistic understanding of their financial status, from which they may make informed investment decisions. |

Goal Investing Portfolio In addition, the eWealth robo-advisor helps analyse a client's financial resources and assesses his/her suitability in investing in Thematic portfolios. This step provides clients with a more holistic understanding of their financial status, from which they may make informed investment decisions.

|

Thematic Investing Portfolio Thematic investing is tailored for investors with a larger risk appetite who wish to capitalise on a specific secular or cyclical trend. A Thematic portfolio aims to achieve excess market returns using stocks or shares from within a country or sector or that span across regions and sectors. With a range of existing Thematic portfolios and new ones being added, one is sure to find the portfolio of their interest. Examples include:

|

Trading Tools

Title Here

- Point One

- Point Two

- Point Three

Title Here

Open an account now

1800 6227272 / (65) 62108453

clientservices.sg@cgsi.com

Download our registration form and mail it to the desired branch with all the enclosures.

![]() Show all Singapore branches

Show all Singapore branches